Functions of commercial banks

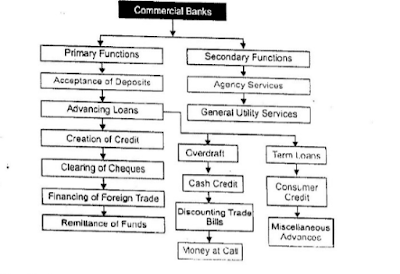

Commercial banks have to perform a variety of functions that are common to both developed and developing countries. These are known as `General Banking’ functions of the commercial banks. The modern banks perform a variety of functions. These can be broadly divided into two categories: (a) Primary functions and (b) Secondary functions.

Primary Functions

Primary banking functions of the commercial banks include:

01. Acceptance of Deposits

02. Creation of Credit

03. Clearing of Cheques

04. Financing of Foreign Trade

05. Advancing Loans

06. Remittance of Funds

1. Acceptance of Deposits:

Accepting deposits is the primary function of a commercial bank mobilize savings of the household sector. Banks generally accept three types of deposits viz. (a) Current (Deposits (b) Savings Deposits, and (c) Fixed Deposits.

(a) Current Deposits

These deposits are also known as demand deposits. These deposits can be withdrawn at any time. Generally, no interest is allowed on current deposits, and in case, the customer is required to leave a minimum balance undrawn with the bank. Cheques are used to withdraw the amount. These deposits are by businessmen and industrialists who receive and make large payments through banks. The bank levies certain incidental charges on the customer for the services rendered by it.

(b) Savings Deposits

This is meant mainly for profession& men and middle class people to help them deposit their small savings. It can be opened without any introduction. Money can be deposited at any time but the maximum cannot go beyond a certain limit. There is a restriction on the amount that can be withdrawn at a particular time or during a week. If the customer wishes to withdraw more than the specified amount at any one time. He has to give prior notice. Interest is allowed on the credit balance of this account. The rate of interest is greater than the rate of interest on the current deposits and less than that on fixed deposit. This system greatly encourages the habit of thrift or savings.

(c) Fixed Deposits

These deposits are also known as time deposits. These deposits cannot he ‘withdrawn before the expiry of the period for which they are deposited or without giving a prior notice for withdrawal. If the depositor is in. need of money, he has to borrow on the security of this account and pay a slightly higher rate of interest to the bank. They arc attracted be the payment of interest which is usually higher for longer period. Fixed deposits are liked by depositors both for their safety and as well as for their interest. In India, they are accepted between three months and ten years.

2. Advancing Loans

The second primary function of a commercial bank is to make loans and advances to all types of persons, particularly to businessmen and entrepreneurs. Loans are made against personal security, gold and silver, stocks of goods and other assets. The most common way of lending is by:

(a) Overdraft Facilities

In this case, the depositor in a current account is allowed to draw over and above his account up to a previously. Agreed limit. Suppose a businessman has only Rs. 30,000/- in his current account in a bank but requires Rs. 60,000/- to meet his expenses. He may approach his bank and borrow the additional amount of Rs. 30,000/-. The bank allows the customer to overdraw his account through cheques. The bank, however. Charges interest only on the amount overdrawn from the account. This type of loan is very popular with the Indian businessmen.

(b) Cash Credit

Under this account, the bank gives loans to the borrowers against certain security. But the entire loan is not given at one particular time, instead the amount is credited into his account in the bank; but under emergency cash will be given. The borrower is required to pay interest only on the amount of credit availed to him. He will be allowed to withdraw small sums of money according to his requirements through cheques, but he cannot exceed the credit limit allowed to him. Besides, the bank can also give specified loan to a person, for a film against some collateral security. The bank can recall such loans at its option.

(c) Discounting Bills of Exchange

This is another type of lending which is very popular with the modern banks. The holder of a bill can get it discounted by the bank, when he is in need of money. After deducting its commission, the bank pays the present price of the bill to the holder. Such bills form good investment for a bank. They provide a very liquid asset which can be quickly turned into cash. The commercial banks can rediscount, the .discounted bills with the central banks when they are in need of money. These bills are safe and secured bills. When the bill matures the bank can secure its payment from the party which had accepted the bill.

(d) Money at Call

Bank also grant loans for a very short period, generally not exceeding 7 days to the borrowers, usually dealers or brokers in stock exchange markets against collateral securities like stock or equity shares, debentures etc.. Offered by them. Such advances are repay able immediately at short notice hence, they are described as money at call or call money.

(e) Term Loans

Banks give term loans to traders, industrialists and now to agriculturists also against some collateral securities. Term loans are so-called because their maturity period varies between 1 to 10 years. Term loans, as such provide intermediate or working. Capital funds to the borrowers. Sometimes, two or more banks may jointly provide large term loans to the borrower against a common security. Such loans are called participation loans or consortium finance.

(f) Consumer Credit

Banks also grant credit to households in a limited amount to buy some durable consumer goods such as television sets, refrigerators, etc., or to meet some personal needs like payment of hospital bills etc. Such consumer credit is made in a lump sum and is repayable in instalments in a short time. Under the 20-point programme, the scope of consumer credit has been extended to cover expenses on marriage funeral etc. as well.

(g) Miscellaneous Advances

Among other forms of bank advances there are packing credits given to exporters for a short duration, export bills purchased/discounted, import finance-advances against import bills, finance to the self-employed, credit to the public sector, credit to the cooperative sector and above all, credit to the weaker sections of the community at concessional rates.

3. Creation of Credit

A unique function of the bank is to create credit. Banks supply money to traders and manufacturers. They also create or manufacture money. Bank deposits are regarded as money. They are as good as cash. The reason is they can be used for the purchase of goods and services and also in payment of debts. When a bank grants a loan to its customer. It does not pay cash. It simply credits the account of the borrower. He can withdraw the amount whenever he wants by a cheque. In this case, bank has created a deposit without receiving cash. Thai is. Banks are said to have created credit. Sayers says -banks are not merely purveyors of money, but also in an important sense, manufacturers of money.”

4. Promote the Use of Cheques

The commercial banks render an important service by providing to their customers a cheap medium of exchange like cheques. It is found much more convenient to settle debts through cheques rather than through the use of cash. The cheque is the most developed type of credit instrument in the money market.

Financing Internal and Foreign Trade

The bank finances internal and foreign trade through discounting of exchange bills. Sometimes, the bank gives short-term loans to traders on the security of commercial papers. This discounting business greatly facilitates the movement of internal and external trade.

6. Remittance of Funds

Commercial banks, on account of their network of branches throughout the country, also provide facilities to remit funds from one place to another for their customers by issuing bank drafts, mail transfers or telegraphic transfers on nominal commission charges. As compared to the postal money orders or other instruments, bank drafts have proved to be a much cheaper mode of transferring money and has helped the business community considerably.

B. Secondary Functions

Secondary banking functions of the commercial banks include:

1. Agency Services

2. General Utility Services

These are discussed below.

1. Agency Services

Banks also perform certain agency functions for and on behalf of their customers. The agency services are of immense value to the people at large. The various agency services rendered by banks are as follows:

(a) Collection and Payment or Credit Instruments

Banks collect and pay various credit instruments like cheques, bills of exchange, promisor notes etc., on behalf of their customers.

(b) Purchase and Sale of Securities

Banks purchase and sell various securities like shares, stocks, bonds, debentures on behalf of their customers.

(c) Collection of Dividends on Shares

Banks collect dividends and interest on shares and debentures of their customers and credit them to their accounts.

(d) Acts as Correspondent

Sometimes banks act as representative and correspondents of their customers. They get passports, traveler’s tickets and even secure air and sea passages for their customers.

(e) Income-tax Consultancy

Banks may also employ income tax experts to prepare income tax returns rear their customers and to help them to get refund of income tax.

(f) Execution of Standing Orders

Banks execute the standing instructions of their customers for making various periodic payments. They pay subscriptions, rents, insurance premia etc., on behalf of their customers.

(g) Acts as Trustee and Executor

Banks preserve the ‘Wills’ of their customers and execute them after their death.

2. General Utility Services

In addition .to agency services, the modern banks provide many general utility services for the community as given.

(a) Locker Facility

Bank provide locker facility to their customers. The customers can keep their valuables, such as gold and silver ornaments, important documents; shares and debentures in these lockers for safe custody.

(b) Traveler’s Cheques and Credit Cards

Banks issue traveler’s cheques. To help their customers to travel without the fear of theft or loss of money. With this facility. The customers need not take the risk of carrying cash with them during their travels.

(c) Letter of Credit

Letters of credit are issued by the banks to their customers certifying their credit worthiness. Letters of credit are very useful in foreign trade.

(d) Collection of Statistics

Banks collect statistics giving important information relating to trade, commerce, industries, money and banking. They also publish valuable journals and bulletins containing articles on economic and financial matters.

(e) Acting Referee

Banks may act as referees with respect to the financial standing. Business reputation and respectability of customers.

(f) Underwriting Securities

Banks underwrite the shares and debentures issued by the Government. Public or private companies.

(g) Gift Cheques

Some banks issue cheques of various denominations to be used on auspicious occasions.

(h) Accepting Bills of Exchange on Behalf of Customers

Sometimes, banks accept bills of exchange, internal as well as foreign, on behalf of their customers. It enables customers to import goods.

(i) Merchant Banking

Some commercial banks have opened merchant banking divisions to provide merchant banking services.

C. Fulfillment of Socio-Economic Objectives

In recent years, commercial banks, particularly in developing countries have been called upon to help achieve certain socio-economic objectives laid down by the state. For example, the nationalized banks in India have framed special innovative schemes of credit to help small agriculturists, village and cottage industries, retailers, artisans, the self-employed persons through loans and advances at concessional rates of interest. Under the Differential Interest Scheme (D.I.S.) the nationalized banks in India advance loans to persons belonging 10 scheduled tribes, tailors, rickshaw-walas, shoe-makers at the concessional rate of 4 per cent per annum. This does not cover even the cost of the funds made available to these prioritysectors. Banking is, thus, being used to subserve the national policy objectives of reducing inequalities of income and wealth, removal of poverty and elimination of unemployment in the country. It is clear from the above that banks help development of trade and industry in the country. They encourage habits of thrift and saving. They help capital formation in the country. They lend money to traders and manufacturers. In the modern world, banks are to be considered not merely as dealers in money but also the leaders in economic development.

You can read more articles about Agricultural Economics

Important Agricultural Websites